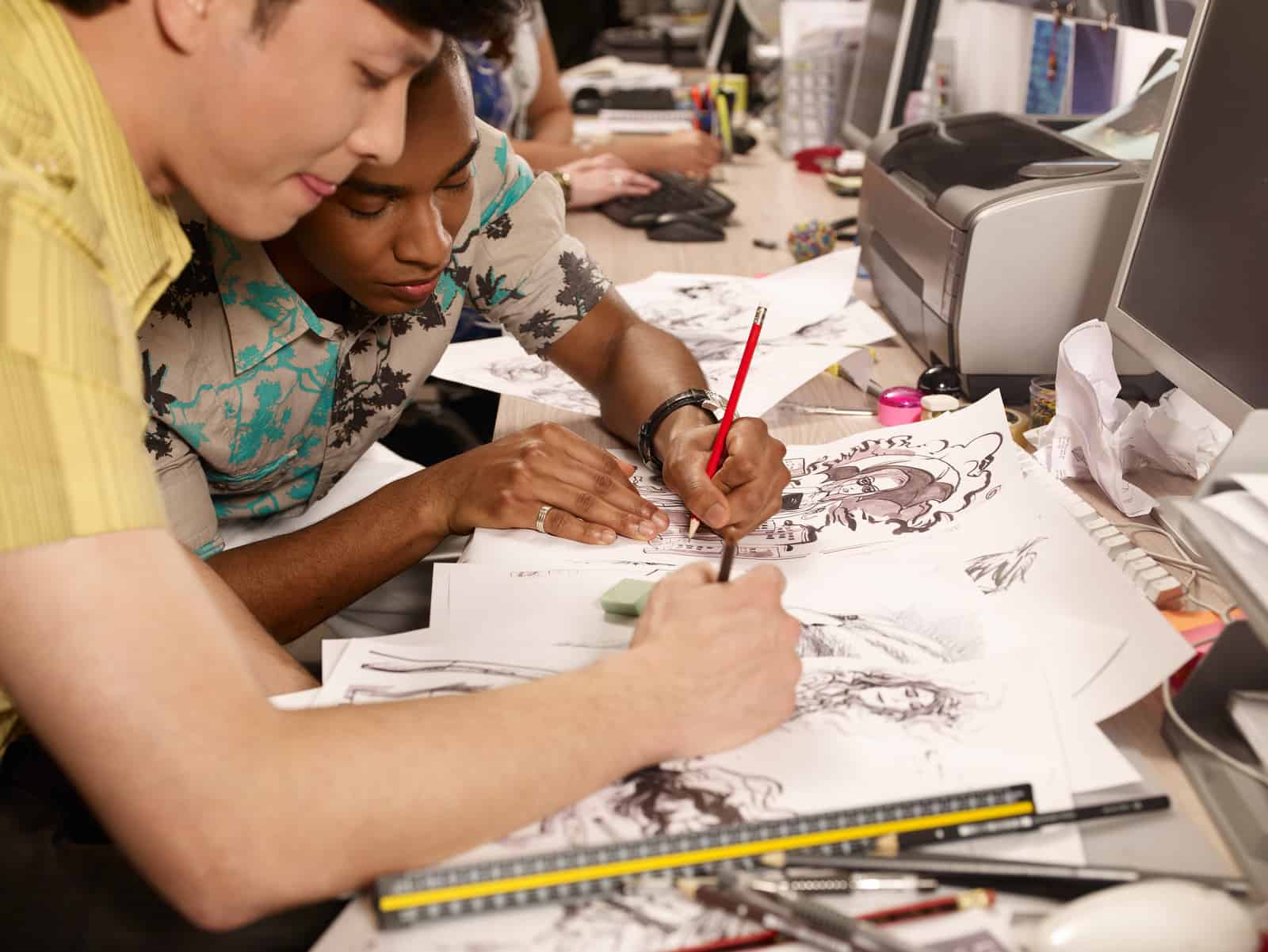

The starving artist stereotype is one of the most commonly believed myths about artists. Whenever occupation talk comes up, artists are often met with looks of pity and comments about the lack of money in the art industry.

As artists, we know this couldn’t be farther from the truth. There are hundreds of successful artists in the art world who are thriving in their mediums. With a little planning and financial insight, artists can create and build wealth.

We know that personal finance can seem overwhelming. However, when you have a clear plan, even the most complex financial solutions can become simple. So if you’re an artist looking to better your financial situation and grow your wealth, we’ve put together the perfect guide for you based on the 7 Baby Steps by Dave Ramsey.

Here are seven ways to help you bust the starving artist myth and start taking control of your finances today.

1. Create a Starter Emergency Fund

Your first step to busting the starving artist myth is to create a starter emergency fund. Many people think it’s best to start attacking their debt or aggressively paying off all their bills. While this may work for a while, what happens when you run into some surprise bills or unexpected costs? An emergency fund gives you a cushion you can fall back on should you have, well, an emergency.

Dave Ramsey recommends that you have an emergency fund of at least $1,000 to start. Of course, you can always add more, but this is a perfect starting point.

When you start working your way out of debt, the last thing you want is to fall back into the hole. A starter emergency fund ensures that you don’t erase all your hard work by needing to use credit cards for last-minute purchases.

2. Get Rid of All Debt

Once you’ve got your starter emergency fund, you can work at attacking your debt. This debt could consist of any car loans, school loans, or credit card balances you’ve accrued over the years. To figure out what to pay off first, begin by putting your debts in order from smallest to largest. Don’t worry about the interest rate; for now, only look at the balance.

Take the smallest account and give that one your full attention. Make minimum payments on all the other accounts, but throw everything you’ve got at the smallest one. Once you’ve finished paying that one, take those payments and move onto the second smallest balance. You’ll continue making minimum payments on the remaining accounts during this time.

This method is called the debt snowball method, and millions of people have found it helpful in paying off their debt. With this method, you can knock out your debt payments one by one, getting you closer to financial freedom.

3. Save 3 – 6 Months of Expenses

With your debt out of the way, this frees up all that extra money to continue putting it towards your emergency savings fund. Build off the $1000 you already have and aim to save between 3 – 6 months of monthly expenses. This money will make sure that you can handle life’s more significant emergencies, such as losing a job or if your car breaks down unexpectedly.

4. Invest 15% of Income in Retirement

It’s never too early to start thinking about retirement. After you save 3 – 6 months of expenses, start by investing 15% of your income into a retirement account. Then, if your employer offers a 401(k), you can start by investing in matching their amount. Once you’ve got that squared away, your next step should be to open a Roth IRA. You can open one for yourself, and if you’re married, open one for your spouse.

5. Save for Future Funds

At this point, you’ve hopefully paid off all your debts and began saving for retirement. You can now start putting money for future funds. For example, if you have children, you might start to put money towards their college funds. You can do this by looking into special Education Savings Accounts (ESAs) or 529 college savings plans.

If you’re single, you can decide what you’d like to do with this money. This could be anything from starting a dream home fund to simply putting money away to buy that campervan you’ve always wanted. Whatever you choose, you’ll pat yourself on the back for saving the money when the time comes to spend it.

6. Pay Off Your Home Early

Congratulations! You’ve come so far already. The last hurdle standing between you and financial freedom is your house payment. Can you imagine a life with no monthly mortgage payment? We can, and you should be able to as well.

Take time to do the math and check how much paying off your mortgage early will save you in interest. On average, homeowners save tens to hundreds of dollars in interest by paying off their mortgage early. However, be sure to look into any possible prepayment penalties you may be subject to while paying off your mortgage early.

7. Build Wealth and Give Back

For people with no debt, the sky’s the limit. There are endless opportunities opened to you once you’re free from the shackles of debt. When you build wealth, you are free to give back to your community and those around you.

Not only will you be able to leave a generation of wealth for your children and grandchildren, but you can make a difference in your area too. You’re free to live life exactly as you want, with no limitations. How amazing is that?

Art For Your Cause Helps Artists Build Wealth

Here at Art For Your Cause, we don’t believe in the starving artist myth. Instead, we’ve seen firsthand that artists can be successful and wealthy members of society while giving back to their community.

Join our artist marketplace to start selling your art with us. We’re working to change the narrative of art and giving through our social enterprise art market. We help artists give back to the community without suffering a loss.

Sign up with AFYC to start selling your art with us today.